As an entrepreneur, I pride myself in excellence and efficiency. However, when it comes to investing I’m anything but. I’ve tried just about everything from real estate to cryptocurrency, from mutual funds to individual stock picks. Most of those investments have been a colossal failure. However, I didn’t face any fears of bankruptcy because I had a foundation (huge shout out to my wife here for that!)

Like any good strategy, you need a core foundation. Investing is no different. Typically you want 50% or more of your savings in some sort of very low-risk investment. This means your money grows slower but the chances of you losing it are far less. Keep in mind I’m lumping all this money together, however, you’ll want your emergency fund and living expenses to be in a no-risk money market account. This leaves the other chunk to invest.

In addition, it’s helpful to think about putting this money “away” for 10 years or more. In 10 years, you’ll likely experience at least one down cycle, but it’s long enough that you’ll see it come back.

The big reason behind this strategy is to give you a foundation to work from. As entrepreneurs, we want to explore and invest in different opportunities. However, many of those investments come with exciting (and potentially devastating) risks. With a strong foundation in place you can deploy your money with varying levels of risk and still be confident that you have your retirement covered should things go wrong.

At this level of investing you only need to know a few things.

- Does this investment vehicle make money? (interest rate)

- Is it likely to continue making money? (track record)

- Is this company a good steward? (low expenses)

- What happens when I need my money? (are there early withdrawal fees or hidden risks associated with time)

Bonds

Typically if you’re reading about investments they discuss bonds as the lowest risk investment. However, for the last 20 years bonds have been a low return and create unnecessary difficulty when accessing your money. Still, because they are a staple of nearly every financial advice post on the internet they are at least worth covering here.

Essentially with a bond, you’re buying someone else debt. The most popular ones are from the US Government, but there are other types of bonds as well. Your grandmother probably has a few of these. They are things you buy that grow in value and “mature” in 30 years. Most of them have penalties for cashing out early.

I-Bond

The only US Bond you can find any recommendations on is the I-bond. Don’t be fooled by its cool first letter, “I” doesn’t stand for internet or interactive, but rather inflation. Currently, the bond pays 2.2%. That’s just above the interest paid by some banks on savings accounts. With all the restrictions around this savings vehicle, I can’t really recommend it. However, the concept is that you buy this bond as a hedge against inflation. To put it another way, “at least your money won’t go down and won’t become less valuable due to inflation while in this investment.”

Corporate, High Yield and Other Bonds

Today’s corporate bonds resemble”fixed” mutual funds. They offer a higher than average interest rate (compared to US bonds) as well as varying levels of “hold time”. In addition, there are fees that are calculated into the rate. It’s important to read the fine print on these newer bonds. Bonds come in all shapes and sizes and for the most part, if you are extremely risk-averse you might find one that offers you rates that are as high as 6% (as of this writing).

Key Factors For Bonds

- Typically long holding periods. Especially if you want higher rates.

- Lower interest rate than any other investment

- Can have fees

- Can have penalties for early withdrawal

Recommendation: I don’t recommend bonds to anyone except the most risk-averse person. Inflation is a real threat. If you’re reading this and you’re thinking about burying some of your money in the backyard to protect it, then a bond might actually be a decent option for you. For everyone else, it’s hardly more than a novelty.

Index Funds

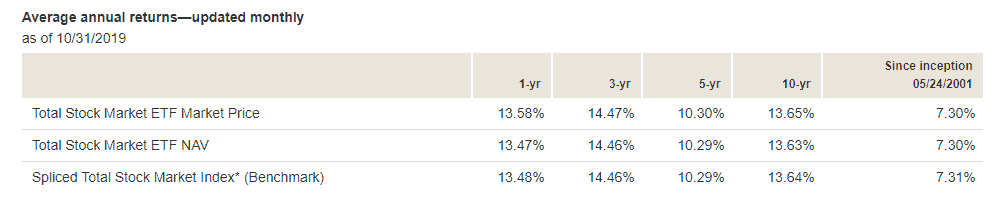

An index fund is a type of mutual fund that is simply a collection of stocks tied together. There are a variety of index funds, such as the total market index which is every stock in the stock market and index funds centered around other things like the S&P and Dow Jones. Index funds trade the high gains of specialized industry niche mutual funds for security in diversification. When a down market happens in one sector, the other sectors tend to hedge against this.

The key is long term thinking. Down markets are inevitable. In 2008 everyone lost money in the stock market. However, as the image shows below, if you didn’t take your money out, then you’re back up again.

I recommend Vanguard Index funds. You can search through their site and decide which ones you like. The general rule of thumb here is that you want to select ones that have been performing well for over 10 years and that have been around for a long time and one that has low expenses. The image above is of the total market index and if it weren’t for the colossal meltdown in 2008 then you’d likely see double-digit returns.

Other good options

- TIAA Equity Index

- tiaacref.org

- Invests in approximately 3,000 companies

- Expense: 0.26%

- Schwab Total Stock Market Index Fund

- schwab.com

- Invests in 4,000 companies

- Expense: 0.09%

- Fidelity Four-in-One Index Fund

- fidelity.com

- Invests 48% in 500 largest stocks, 12% in rest of U.S. stock market, 25% in international stock index, 15% in bond index

- Expense: 0.36%

Recommended: Put the majority if not all of this “foundation” money in a total market index fund

Note: I mention Vanguard here because I use them and think they are great. They don’t have an affiliate program and there is no benefit to me if you use them. You should do your due diligence.

The idea of this post isn’t that it provides you with an end-all strategy. It’s so you have a foundation of growth on top of your savings. You get this part right and you can venture off into the more risky territory of real estate investing, individual stocks or something else.

Key Takeaway

- 50% or more of your “investments” should be in a long term hold strategy with something like an index fund.